Insurance instruments and disaster resilience in Europe – insights from the ENHANCE project

Insurance is a key economic instrument in the context of DRR, offering a shift in the mobilisation of financial resources away from ad hoc post-event payments, where funding is often unpredictable and delayed, toward more strategic and, in many cases, more efficient approaches that were arranged in advance of disastrous events. The main function of insurance is the financial transfer of risks and compensation for losses. However, if correctly designed and implemented, it can also support disaster risk reduction (DRR) and climate adaptation. Within this context, insurance may be delivered using a range of approaches, such as risk pools, private insurance, or public insurance schemes, addressing different hazards at different scales, including property, agriculture, and sovereign risk insurance. Feasibility, effectiveness, and the potential for incentivising behavioural change vary across the different types and forms of insurance. Methodologies for comparing and assessing these characteristics are currently starting to emerge.

While it is clear that insurance can contribute to disaster risk management, a range of challenges also exists, including a lack of comprehensive information and cognitive biases, as well as financial constraints and moral hazard.

The ENHANCE project considers two key questions in the context of natural disaster insurance and risk reduction:

- How to assess existing insurance offerings

- How to design new insurance schemes that strengthen and incentivise DRR.

ENHANCE introduces six different methodologies for assessing the linkages between insurance and risk reduction:

- Stress testing

- Investigation of flood insurance and moral hazard

- Estimation of effectiveness of household-level food risk mitigation measures

- Assessment of risk-based insurance pricing incentives for flood risk mitigation

- Analysis through a risk reduction framework

- Investigation of the design principles of insurance

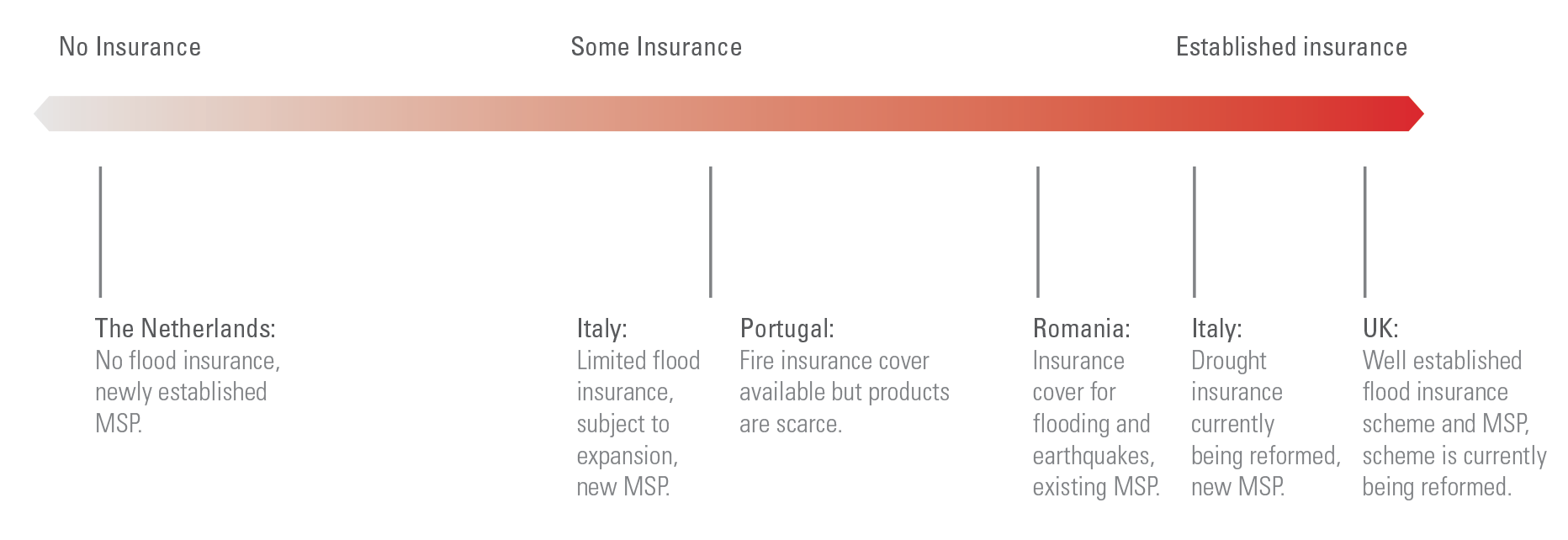

Based on the case studies, our analysis reveals a range of important insights that are relevant to individuals who consider, design, operate, or participate in insurance schemes. An area of particular interest is the role of MSPs for the provision of disaster insurance. Here, our case studies (Figure 5.1) highlight the importance of increased evidence and understanding of underlying risk issues, enhanced collaboration of stakeholders, and openness about limitations and costs. The issue spans many dimensions, which makes innovation and reform challenging for political decision-makers and private companies.

Figure 5.1.

ENHANCE case studies with insurance focus.

| Multi-hazard risk assessment in Po River basin (Italy) Controlled flooding as a last resort of flood control

|

Flooding and drought pose two major concerns in the Po River Basin. Whereas state-subsidised agricultural yield insurance is in place, flood insurance uptake remains low and disaster losses are typically compensated by the state. The role of agricultural insurance in wide-reaching water management reform is analysed and the opportunities are shown for disaster risk reduction through cooperative agreements and partnerships. |

| Flood risk and climate change implications for Multi-Sector Partnerships (United Kingdom) Evaluation of multi-sectoral partnerships (MSPs): flood risk management and climate change in London

|

Insurance is provided by private insurers. To address concerns about affordability of insurance a new pooled approach (Flood Re) has been introduced, funded through a levy on all home insurance policies. The design and implementation of Flood Re highlights the challenges of addressing affordability in times of rising risks. Risk reduction and prevention elements are not integral to the new system. |

| Insurance and forest fire resilience in Chamusca (Portugal) Forest fires and insurances in Portugal

|

Forest insurance is mandatory yet insurance products are scarce in delivering insurance solutions. The case study explores the options for introducing a new forest fire insurance scheme, with a view on risk reduction elements. |

| Flood risk management for critical infrastructure (The Netherlands) Flood risk management Port of Rotterdam

|

Provision of flood risk management in a high risk area presents several challenges for effective application and an innovative multi stakeholder approach aims to deliver a reduction in societal risk. |

| Reforming natural hazard insurance (Romania) Flood risk: the EUSF and Romania

|

Mandatory natural hazard insurance is required under law for residential properties in Romania yet includes no risk reduction elements. The case study investigates the recent changes to the insurance system. |

| Reforming the European Union Solidarity Fund in support of insurance Flood risk: the EUSF and Romania

|

Using a supranational fund such as the European Union Solidarity Fund could provide a link to potential ex-ante capitalisation of disaster funding for risk reduction action. The case study focuses on the options for aligning the EUSF with insurance solutions. |

Table 5.1.

The different ENHANCE insurance case studies.

Flood insurance developments in Europe: fit for the future?

On the 23rd and 24th of October 2014, Dr Swenja Surminski, Senior Research Fellow at the London School of Economics (LSE) participated in the 6th Extreme Events and Climate Risks seminar organised by the Geneva Association in New York. On this occasion, Dr Surminski was interviewed and talked about current developments in flood insurance in Europe, the role of insurance in disaster risk resilience and partnerships.

Watch the interview for more insights!