The ENHANCE framework

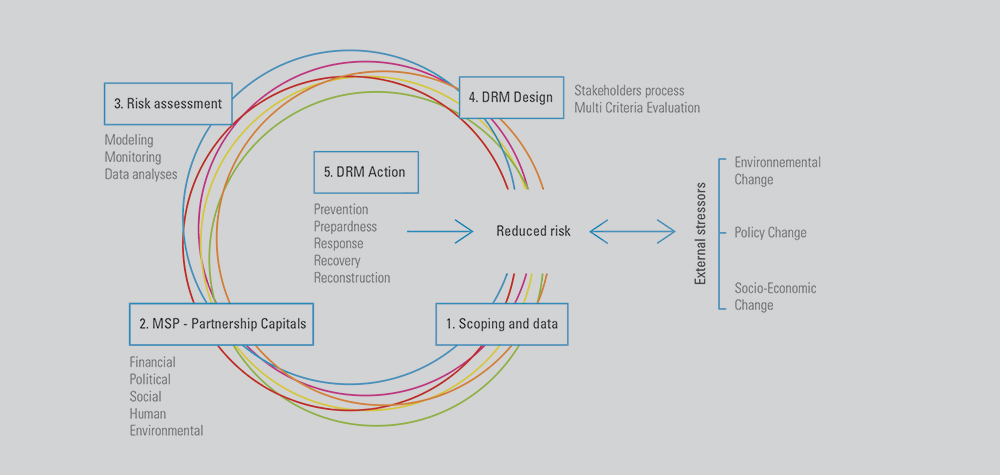

Figure 1.1 describes the general approach that was followed by ten ENHANCE case studies (See Table 1.1). Following the main components of Figure 1.1, the main activities of each case study were:

- to assess the capacity of each existing MSP to reduce or manage risk;

- to assess current and future risk, including extremes and effects from both climate change and socio-economic developments; and,

- to explore DRR measures that were developed and governed by the MSP with the aim of reducing risk.

The relationship between resilience and good governance of MSPs is assessed in ENHANCE by the Capital Approach Framework (CAF) that was developed during the project to assess governance performance. The CAF assesses risk governance performance and the influence of risk perception of MSPs on risk management strategies (Chapter 3).

The CAF differentiates between five capitals, which are understood as dimensions of an efficient risk governance performance: financial, social, human, natural (environmental), and political capital.

The five capitals are described as:

- Social: the relationships, networks, and shared norms and values that qualify and quantify social interactions, which have an effect on partnership productivity and well-being.

- Human: focused on individual skills and knowledge. This includes social and personal competencies, knowledge gathered from formal or informal learning, and the ability to increase personal well-being and to produce economic value. In the case of partnership, the human capital will be the addition of its individual skills and knowledge.

- Political: focuses on the governmental processes, which are done/performed by politicians who have a political mandate (voted by the public) to enact policy. It also includes laws, rules, and norms, which are juristic outcomes of policy work.

- Financial: involves all types of wealth (e.g. funds, substitutions, etc.) that are provided, as well as financial resources that are bounded in economic systems, production infrastructure, and banking industries. Financial capital permits fast reactions to disasters.

- Environmental: comprehends goods and values that are related to land, the environment, and natural resources.

Furthermore, for the risk assessment activities (Chapter 2), different modelling and statistical techniques were implemented to assess the magnitude and frequency of extreme events, such as ‘extreme value analysis’ and joint distribution of risk (‘copula’s’).

Finally, the project explored different economic instruments (Chapter 4), such as pricing and insurance (Chapter 5), as part of the different DRR actions, and explored what type of EU and national policies are required to develop and maintain such instruments to enhance MSPs (Chapter 6).

Overall, the mix of substantive analysis and application to the ten case studies provided by the ENHANCE consortium served as a rich laboratory for studying the way that MSPs may help to achieve the imperative of DRR, as set out globally by the Sendai Framework, Paris Agreement, and the Sustainable Development Goals (SDGs) debates, to be implemented regionally, nationally, and locally across many hazard-prone contexts.

Figure 1.1.

Setup of the ENHANCE framework for assessing the healthiness of MSPs, to assess current and future risk levels, and to reduce and manage risk through DRR design and action.