DRR and economic instruments

Economic instruments (EI), such as subsidies, taxes and insurance-related options are at the heart of discussions regarding novel approaches for managing risk and adapting to climate change, including in the context of multi-stakeholder partnerships (MSP) between the private and public sectors.

Although the attractiveness of reducing and managing disaster risk has long been demonstrated, there is underinvestment into disaster risk management (DRM). A number of factors, such as a lack of comprehensive information and cognitive biases are important. In particular, financial constraints and moral hazard, i.e. adverse incentives provided by current arrangements for dealing with disasters play a large role.

In this line of thinking, instruments that provide a price signal for risk management and incentivise behavioural change hold high appeal by policymakers including in the EU. Yet, little is known about such economic instruments, their mechanics, links to risk management and concrete application in the field of disaster risk management (and climate adaptation). Knowledge gaps exist particularly with regard to conditions that create enabling environments for innovative market-based and risk financing instruments. Among these are, e.g., the attractiveness for stakeholders in the context of MSPs or institutional settings that are required to successfully and efficiently apply the EI.

ENHANCE examined the potential of economic instruments for enhancing resilience and managing and incentivising risk management. The analysis debates how economic instruments may support risk management, including new partnerships between the private and public sectors. Based on an inventory, it applies different assessment techniques to the most promising options by way of case studies, and finally gauges the potential of key economic instruments for incentivising risk management generally via multi-criteria assessment.

The criteria (and associated) indicators comprised the following aspects: economic efficiency, including the link to incentivise disaster risk management, social equity, political and institutional applicability, and environmental effectiveness. Operationalising the criteria universe with a multi-criteria decision-making approach allowed ENHANCE analysts to apply a qualitative scoring matrix to economic instruments across five ENHANCE case studies.

The guiding questions for this part of the ENHANCE project have been:

- What innovative economic instruments exist for managing disaster risk?

- How do they contribute to risk management?

- How do case studies discuss and assess economic instruments?

- What can be learned from the case study application using a common assessment framework?

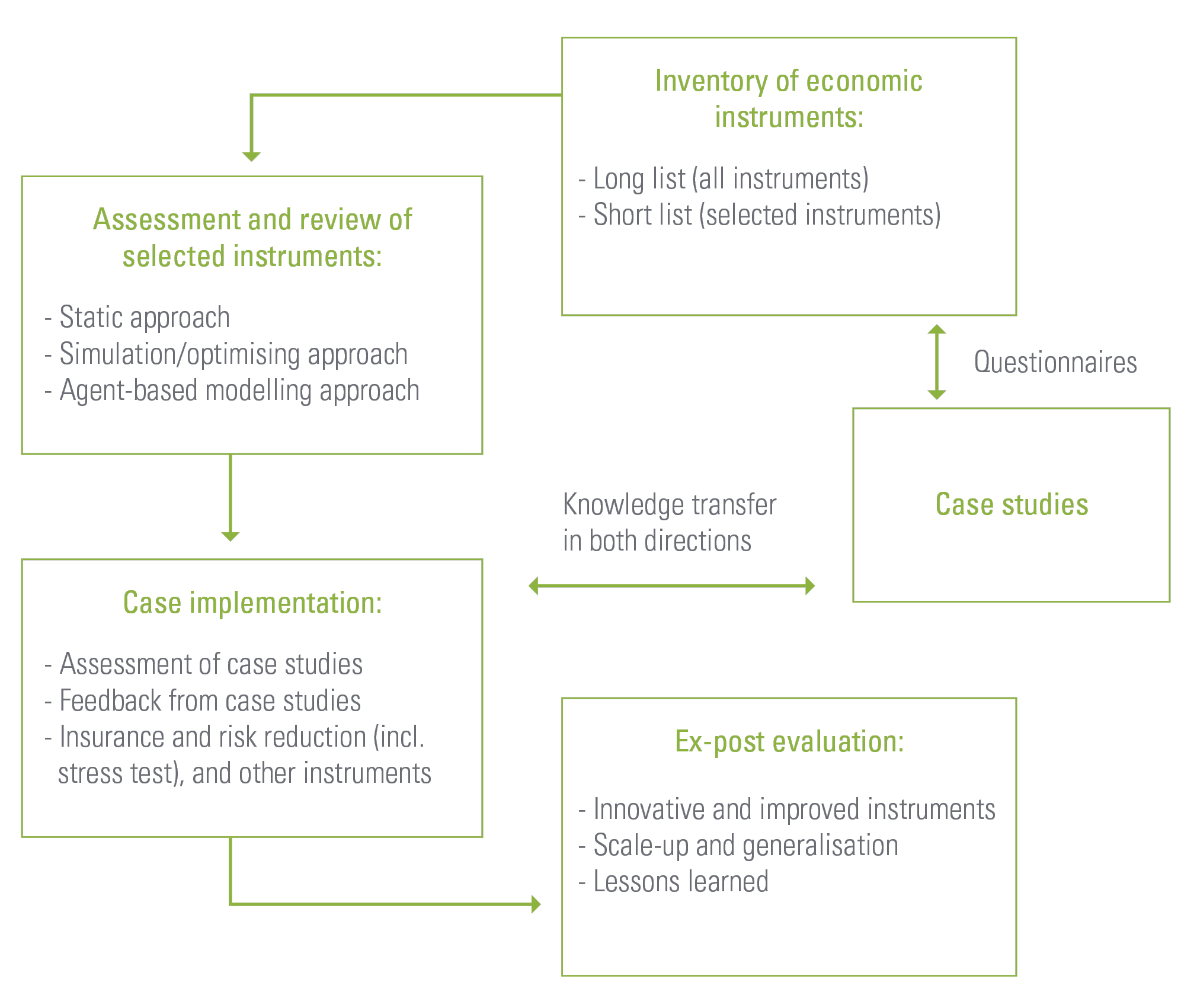

Figure 4.1

Figure 4.1 shows the main tasks carried out for this line of work. A review of the available literature leads to a long list of potential instruments and their general applicability. Screening of anticipated uptake of the instruments in key ENHANCE case studies via a questionnaire submitted to our case study partners produced a short list of instruments, which were implemented and further assessed via modelling and empirical analysis. As the final step, a common framework based on multi-criteria analysis was applied to the case study instruments to assess their specific suitability.